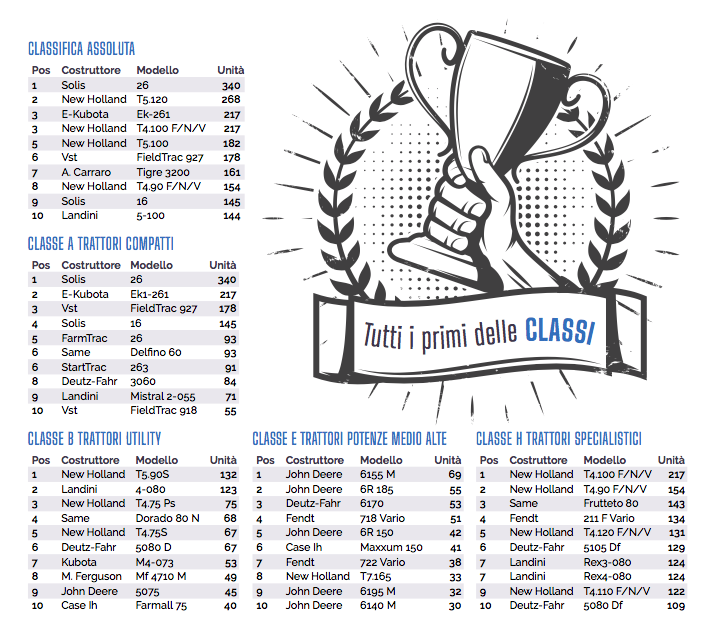

The “Bestseller Award” rankings photograph a ranking of 2024 tractors that shows the most registered vehicles of the past year. They are based on data from the Civil Motorization. Therefore derive from objective data, not being the result of evaluations imposed from above by more or less competent and reliable juries in their judgments.

It is also specified that in the classes in which there are tractors with the same registered volumes, the same tractors are proposed in alphabetical order of brand.

Tractor ranking 2024 – The tables

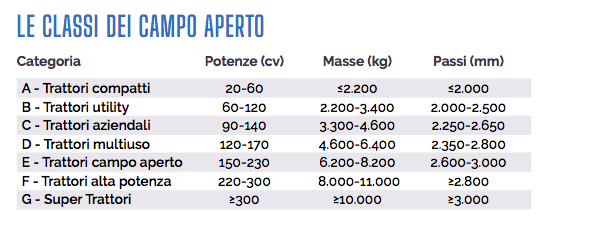

The rules

- The subdivision of classes and names refer to the market. Tractors are classi ed based on power, weight and wheelbase as per the table above.

- The reference powers are the maximum homologation ones.

- The masses of “Compact” tractors are relative to the dual traction/open versions.

- The masses of non-compact tractors are relative to the “Dt” versions, with cab if provided.

- The standard versions of each individual model are valid for the wheelbases.

- The standard versions of each individual model are valid for the steps

- All vineyard tractors (width 1.0/1.2 meters), orchard tractors (width 1.2/1.4 meters) and wide orchard tractors (width 1.4/1.6 meters) are considered “Specialized” and placed in the relevant class.

- All vineyard tractors (width 1.0/1.2 meters), orchard tractors (width 1.2/1.4 meters) and wide orchard tractors (width 1.4/1.6 meters) are considered “Specialized” and placed in the relevant class.

- All tractors that move on tracks are considered “Crawlers”. If they are high-powered, they are included in the “SuperTractors” table.

- Tractors that due to their technical and performance characteristics do not fall into some of the reference classes are considered “exceptions”. They are included, registration volumes permitting, in the reference class closest to them.

Below are some commercial considerations advanced ranking by ranking looking at both the 2024 and 2023 market situations. 2024 saw a boom in low-power Asian compact tractors, less than 35 horsepower, and one of them, the Solis “26”, actually closed the season at the top, a situation induced by price lists that were at times even 50 percent lower than those of European tractors with equal performance.

Tractor market 2024 – Overall Ranking

The overall ranking of the ten most registered tractors in Italy in 2024 sees an Asian tractor, the Solis “26,” in first place. In 2023, this model was in second place, behind the leader, New Holland “T5.120,” which is now in second place.

The roles have thus reversed, confirming a growth trend for low-power Asian tractors, as evidenced by the entry of three other machines of similar origin into the ranking.

This means that four out of ten are Asian models, with the remaining five positions occupied by the same models that were already in the ranking last year, highlighting a decidedly traditionalist market in its choices. Also fitting into this context is the new entry, the Landini “Serie 5-100,” a versatile, modern, and reliable tractor that avoids overly futuristic technical solutions.

Isodiametric Category

Isodiametric tractors, in the intentions of manufacturers, are designed to combine the slope stability typical of tracked tractors with the operational versatility of traditional tractors. Since they partially achieve these goals, they have secured a decent market share—just under eleven percent—which is now essentially divided between Antonio Carraro and three brands under the BCS group: BCS, Ferrari, and Pasquali. For years.

The category ranking has been almost entirely dominated by Antonio Carraro, but for just as long, a tractor from the BCS group has prevented the Venetian manufacturer from achieving a clean sweep. This happened again in 2024, thanks to the BCS “Valiant 60,” which secured the ninth spot in a ranking led by the “Tigre 3200,” a model that also allowed Antonio Carraro to make it into the overall ranking.

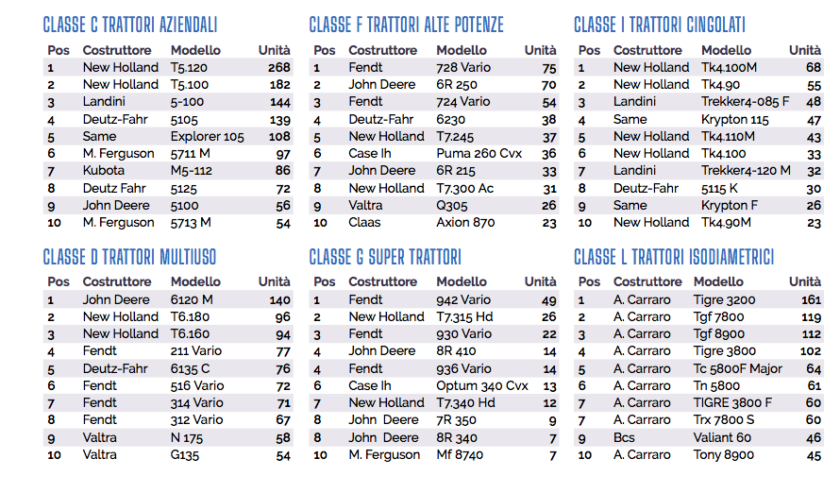

High Power Ranking – Class F

The high-power tractor category is the most coveted by manufacturers, as it represents the design and construction capabilities of each individual brand. It is also characterized by respectable volumes, and every sale ensures decent profit margins.

Confirming this is the presence of seven brands in the ranking, which together make the category highly representative of the market. In 2024, it was dominated by Fendt, whose “728 Vario” pushed the 2023 leader, John Deere “6R 250,” into second place, followed by another Fendt model, the “724 Vario.” Behind this trio were Deutz-Fahr with the “6230,” New Holland with the “T7.245,” Case IH with the “Puma 260 CVX,” Valtra with the “Q305,” and Claas with the “Axion 870.”

It is worth noting that, even in this case, a certain traditionalism can be observed among operators in terms of purchases. Out of the ten models in the ranking, seven were also present in the 2023 Top Ten, demonstrating that when investments are significant, most companies prefer to play it safe.

Corporate Ranking – Cl. C

Versatile tractors that are very popular among small and medium-sized agricultural organizations, corporate tractors, along with specialized tractors, represent one of the strongholds of national agricultural mechanization. This is confirmed by the fact that the top ten tractors in the ranking together account for 1,206 registrations—a volume surpassed only by compact tractors, which benefit from a larger market made up of hobbyists, and by the aforementioned specialized machines.

In this class, Italian manufacturers excel, securing six out of ten positions, with New Holland and Landini claiming the top three spots on the podium, followed by the two brands Deutz-Fahr and Same from the SDF group. Compared to 2023, Valtra drops out of the ranking in favor of a Massey Ferguson “MF 5713M,” and John Deere loses one spot, replacing its “5075E” and “5090M” models with only the “5100.” On the other hand, the Kubota “M5-112” is confirmed, although it drops five positions compared to the previous year.

Open Field Ranking – Cl. E

A category dominated by John Deere, which secures five out of ten spots, including first and second place. However, Deutz-Fahr spoils the party for the Green-Yellow brand by placing its “6170” in third position, marking a remarkable comeback compared to the tenth place achieved in 2023. Case IH and Fendt are confirmed in the ranking, while Valtra drops out, having been in ninth place last year with the “T195.”

Contributing to the Finnish brand’s exit is New Holland, which enters the ranking with its “T7.165,” proudly representing the national flag.

It is worth noting the significant decline in category registrations. In 2023, the leader recorded 111 units, while last year the same tractor stopped at 69, confirming the difficult moment the sector is experiencing after the sales boom driven by post-pandemic aid—support that even the manufacturers’ association, FederUnacoma, deemed excessive, calling for a less substantial but more structural intervention. No one listened, and now the consequences are being felt.

Tracked Tractor Ranking

In 2024, 658 tracked tractors were registered, accounting for just over four percent of total registrations. These are essentially niche tractors and, in their own way, highly specialized, meaning that companies turn to them only when traditional alternatives are not viable.

The category, as always, is dominated by Italian manufacturers, with New Holland leading the way, followed by Landini and Same—the latter making a comeback in the ranking after a disappointing 2023. Also featured in the ranking is a Deutz-Fahr “5115 K,” a green version of the same-powered tracked tractor under the Same brand.

Compact Tractor Ranking – Cl. A

Asia vs. Europe: seven to three. A score that leaves no doubt about the mechanization choices made by less structured companies and hobbyists—the typical customers for these machines—who, unable to benefit from subsidies and having to fully cover the costs of machines and equipment, are highly sensitive to price lists. In this case, prices can be even half of what European tractors cost. Roughly speaking, we are looking at €11,000–€12,000 compared to €21,000–€23,000 to take home a 26-horsepower tractor.

It should be noted that this price difference largely depends on the low labor costs that Asian manufacturers bear and often on the subsidies they receive from their respective governments. A tariff to rebalance the competitiveness of European manufacturers wouldn’t be a bad idea.

Multi-Purpose Tractor Ranking – Cl. D

Class “D” is the first of the three categories that cover medium-high and high-power machines, where foreign tractors clearly dominate over Italian ones, which are, in fact, represented only by New Holland. In this way, the blue machines take second and third place on the podium but fail to challenge the leadership of the John Deere “6120 M,” which has been at the top of this segment for years and is the only tractor in the category to exceed 100 registrations this year, reaching 140.

Behind the Italian brand is a lineup of foreign competitors led by Fendt and closed by Valtra. In practice, six out of ten tractors belong to the AGCO group, two to New Holland, and one each to John Deere and Deutz-Fahr.

Noteworthy is the significant volume of registrations achieved by the tractors in this ranking—805 units—about a hundred more than the 719 credited to the less demanding utility tractors.

Specialized Tractor Ranking

With a volume of nearly 1,400 units achieved by the ten models in the ranking, specialized tractors confirm themselves as the most in-demand machines on the market. Once again, user choices appear very conservative. Out of the ten models, nine are the same as those listed in 2023, with the only exception being the Deutz-Fahr “5080 DF,” which makes its debut by edging out its cousin, the Same “Frutteto 105,” by just four units.

Fendt 211 F Vario

At the top, the New Holland “T4.100 F/N/V” retains its lead, overtaking the lower-powered “T4.90 F/N/V,” which secured the second place previously held by the Fendt “211 Vario F,” now relegated to fourth position in 2024. The Same “Frutteto 080” climbs to the third step of the podium, while all other models more or less hold their previous positions.

Notably, the sector’s performance continues to grow, with New Holland pushing the limits to nearly 120 horsepower with the “T4.120 F/N/V.”

Super Tractor Ranking – Cl. G

Super Tractors used to consist of machines with power close to or just above 300 horsepower. Today, that performance level is merely a starting point, with outputs significantly higher, even exceeding 400 horsepower. Naturally, the registration volumes are considerably lower compared to other categories, making the 49 units achieved by the Fendt “942 Vario”. All the more impressive—nearly double that of the second-place New Holland “T7.315 HD,” which is followed by another Fendt model, the “930 Vario.”

Only in fourth place do we find a John Deere model, the “8R 410.” In 2023, John Deere was represented by five models in the ranking, but in 2024, it lost two spots to Case IH and Massey Ferguson.

Analyzing the ranking by groups, it can be stated that AGCO leads with four machines, followed by CNH and John Deere, each with three tractors.

Utility Tractor Ranking – Cl. B

Out of the ten machines, eight are repeats. The “B” class ranking also demonstrates how, in Italy, the most sold tractors are always the same, even though the preferences of farmers and ranchers change from year to year. As a result, the rankings may shift, but the key players remain the same, except for the exit of the New Holland “T5.090,” which is replaced by the new entry, Case IH “Farmall 75.”

This family shuffle does not prevent the Blue Brand from maintaining its leadership in the category, securing the first and third spots on the podium, along with the fifth position. However, it must give up the second spot to the Landini “Serie 4-080,” which was only tenth in 2023. With its growth, the brand confirms the increasing popularity it is gaining among businesses.

Also noteworthy is the debut of the Massey Ferguson “MF 4710 M,” a tractor built in China at the AGCO plant in Changzhou, which celebrates its first decade of operations this year.

Title – Tractor market 2024: the top ten most registered in Italy

Translation with ChatGPT